Two decades ago, on the 6th of July, Professor Charles Chukwuma Soludo, then Governor of the Central Bank of Nigeria (CBN), introduced a transformative policy that reshaped the Nigerian banking landscape. The Banking Consolidation Policy aimed to strengthen the banking sector, ensuring stability, resilience, and growth. This was a neccesity as Nigeria envisioned becoming a private sector-driven economy.

Building a multi trillion dollar economy required banks that have the capacity to finance such level of growth-syndicate international financing and mobilise large scale facility for business expansion in Nigeria.

As we celebrate this destiny-shaping milestone, it is fitting to recognize the profound impact this policy has had on our economy as a nation:

𝗦𝘁𝗿𝗲𝗻𝗴𝘁𝗵𝗲𝗻𝗶𝗻𝗴 𝘁𝗵𝗲 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗦𝗲𝗰𝘁𝗼𝗿: The consolidation policy reduced the number of banks from 89 to 25, creating stronger and more resilient institutions. This move was crucial in enhancing the capacity of banks to finance larger projects, support businesses, and contribute to economic development.

𝗘𝗻𝗵𝗮𝗻𝗰𝗲𝗱 𝗦𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆: By increasing the minimum capital requirement, the policy ensured that only banks with strong financial foundations survived. This resulted in a more stable banking environment, capable of withstanding economic shocks and fostering investor confidence.

𝗖𝗮𝘁𝗮𝗹𝘆𝘀𝘁 𝗳𝗼𝗿 𝗚𝗿𝗼𝘄𝘁𝗵: The consolidation paved the way for technological advancements and the modernization of banking services. It spurred competition, leading to better customer service and innovative financial products that have benefited millions of Nigerians. Today, banks increasingly invest in Technology that enhances their efficiency because they have the capacity.

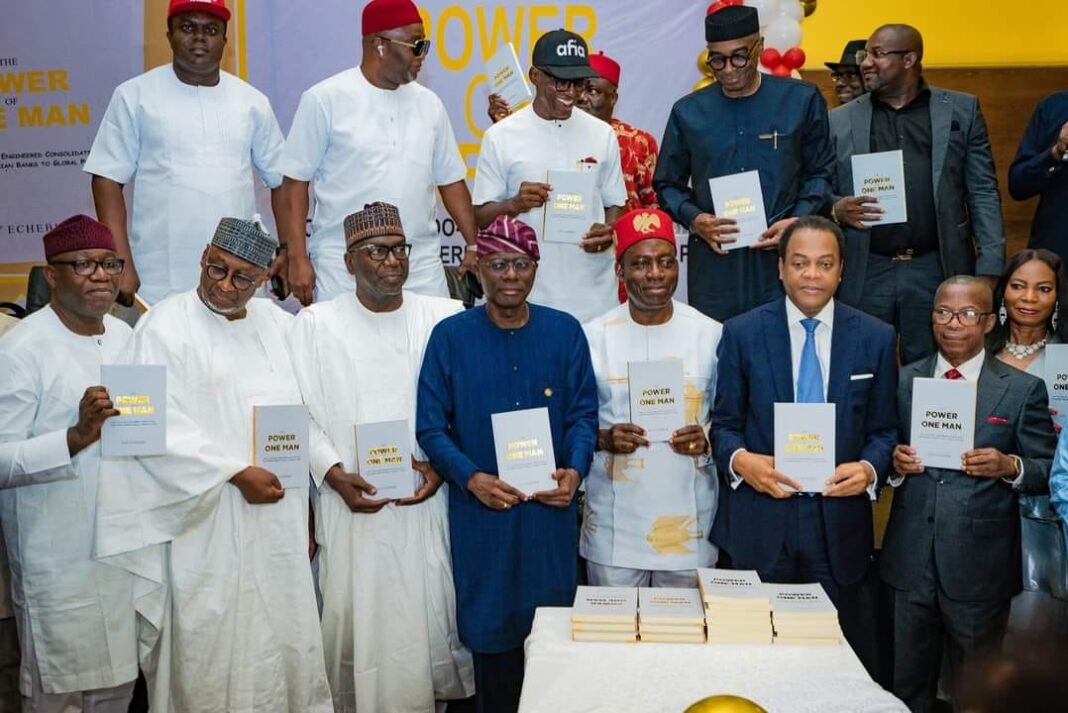

Yesterday, I had the privilege of attending the launch of the book titled 𝗧𝗵𝗲 𝗣𝗼𝘄𝗲𝗿 𝗼𝗳 𝗢𝗻𝗲 𝗠𝗮𝗻:How Soludo-Engineered Banking Consolidation Transformed Nigerian Banks to Global Players; which chronicles the remarkable journey and achievements of Professor C.C. Soludo at the Central Bank.

This book by Ray Echebiri is a testament to the enduring influence of visionary leadership and the positive change a determined leader can bring to a nation. Professor Soludo’s legacy continues to inspire us to strive for excellence and to believe in the power of one person to make a profound difference.

What do you remember about the Nigerian banking industry before the consolidation?