The budget estimate of N13.03 trillion may go the way of its ancestors – a channel of profligacy that shows no departure from the old path

By Samuel Diala

Nigeria is plagued with acute revenue shortage for the past five years because of depleting earnings and low oil prices. This has created severe fiscal challenge that threatens economic development. The attendant impact on quality of lives, among other negative effects, exacerbates the country’s case as the poverty capital of the world.

Amid this quagmire, the Nigerian Government has remained stiff-necked on the path of profligacy in its budget conceptualization and execution. Its attitude to fiscal management has been anything but prudent. Annual budgets showcase adherence to misplaced priorities – a virus that has created systemic pandemic among government ministries, departments and agencies (MDAs).

Despite the revenue challenge, the 2021 Budget Estimate of N13.03 trillion recently unveiled by the Executive shows no departure from the old ways. A close look at the segments reveals a stubborn adherence to the culture of spending that underscores chronic profligacy and corruption. Funds committed to areas of spurious priorities are massive.

It therefore follows, that the fiscal spending Plan (the highest in the country’s history) will, again, constitute a drain to public treasury while poverty, unemployment and inflation rates mount; GDP shrinks.

This indulgence in systemic malfeasance among policy makers, is at the roots of Nigeria’s scandalizing cost of governance – notoriously adjudged the highest in the world. As a result, less resources are available to boost the people’s standard of living.

Budget highlights

The proposed Budget of N13.08 trillion has a revenue expectation of N7.89 trillion, resulting in N5.20 fiscal deficit. This represents 35 per cent, 21 per cent and 4 per cent rise, compared to 2020 revised figures of N5.84 trillion, N10.81 trillion and N4.98 trillion, respectively. Benchmark oil price and oil production volume (bpd) is US$40 per barrel and 1.86 million barrels per day as against US$28 per barrel and production volume of 1.80 million in 2020 revised budgets or 43 per cent and 3 per cent rise, respectively.

Capital expenditure of N3.60 trillion representing 46 per cent over 2020 budget of N2.49 trillion is adopted; while recurrent budget (non-debt) stands at N5.65 trillion as against N4.94 trillion or 14 per cent rise over the 2020 figures. Average exchange rate for 2021 is N379/US$1 representing 5 per depreciation or 5 per cent above N360/US$1 budgeted in 2020. GDP growth rate of 3 per cent for 2020 is 168 per cent over -4.42 per cent adopted in 2020.

Provision for debt service (inclusive of sinking fund) increased from N2.95 trillion in 2020 to N3.34 trillion in 2021 or 13 per cent spike; while inflation rate of 11.95 for 2021 shows a drop of -15 per cent compared to 14 per cent in 2020 budget.

Allocations/Implications

A notorious pattern of Nigeria’s budget practice is its overwhelming bent towards recurrent against capital expenditure. It is generally regarded as a budget of methodical consumption. Huge allocations are created and channeled towards debt and non-debt recurrent budgets without a corresponding economic impact on wealth creation.

The immediate casualties of this age-long fiscally injurious practice are Investment and Infrastructure which suffer a third-degree burnt. When other related factors that readily drag development, such as skill deficiency and unconducive environment come to bear, the outcome is clear: worsening case of underdevelopment and poverty. The people, evidently, suffer.

A worrying trend is that, in recent times, the country borrows to finance consumption because of shortfall in revenue. This leads to poor or non-execution of capital budgets. On the other hand, recurrent expenditures are fully executed using borrowed funds meant for capital budget. Stakeholders and industry experts decry this anomaly as the bane of Nigeria’s fiscal development.

“I am not against borrowing, but I am against borrowing for consumption. Budgets are funded globally through borrowing. There is nothing wrong with that because nobody prints money on its own. If we borrow for investment, there is nothing wrong with that. It is morally irresponsible, the worst form of corruption, for you to borrow and consume and leave the payment for the future generation,” said Peter Obi, former governor of Anambra state, in a recent media interview.

The root cause is that Nigeria’s economy is largely public-sector driven. She runs an over-bloated bureaucracy, about the most expensive government in the world. She saves a little, consumes much and, at the same time, engages in massive waste and mismanagement. Little remains for investment. The situation becomes more precarious in the event of a price shock, recession or natural disaster such as the novel Covid-19 pandemic.

The 2021 Budget proposal, if approved by the National Assembly will, inevitably, fast-track Nigeria’s trudge on the path of profligacy towards bankruptcy. As noted, this is because there are several, items of huge expenditure that constitute waste, mismanagement, notorious indulgence, abuse and corruption. You cannot have your cake and eat it, as the agelong maxim goes.

Capital Vs Recurrent

The 2021 Budget Estimate has recurrent expenditure (non-debt) of N5.65 trillion as against N4.94 trillion budgeted for (revised) 2020 – representing 14 per cent rise. Provision for recurrent debt service (inclusive of sinking fund) is N3.34 trillion or 13 per cent over N2.95 trillion for 2020. Capital expenditure budget is N3.60 trillion as against N2.49 trillion in 2020 which is 46 per cent positive change. Capital expenditure is N2.05 trillion or 36.38 less than non-debt recurrent budget; or N5.39 trillion less than entire recurrent expenditure representing 60 per cent.

The deficit will be financed mainly by new borrowings amounting to N4.28 trillion, N205.15 billion from privatization proceeds and N709.69 billion. These will be in drawdowns on multilateral and bilateral loans secured for specific projects and programmes. It should be noted that the N5.20 trillion deficit, representing 3.64 per cent of estimated GDP, is above the 3 per cent threshold set by the Fiscal Responsibility Act, 2007. Notwithstanding the 23.85 per cent of the budget going into debt servicing, the federal government’s fresh loans amount to over 30 per cent of the budget size.

Analysis of the document showed that over 40 per cent of the revenues, assuming fully realized, will be used for debt servicing. Specifically, debt servicing and new loans will amount to N8.32 trillion. This is a source of worry as Nigeria recorded debt service to revenue ratio of 99 per cent in the first quarter of 2020.

“This ‘Budget of Economic Recovery and Resilience’ will simply strangulate Nigerians further because it is dead on arrival. Any country desirous of development must place emphasis on capital expenditure. But the reverse is the case in Nigeria. Budget 2021 is no exception. The recurrent outlay is N6.11 trillion, while the capital outlay is N3.85 trillion. This proposed recurrent outlay is almost double that of the capital expenditure. This means that Nigeria is still heavy on recurrent expenditure”, said Yemi Adebowale, a financial analyst.

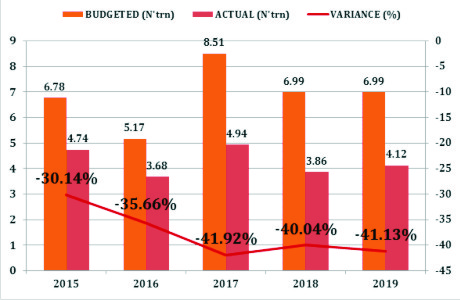

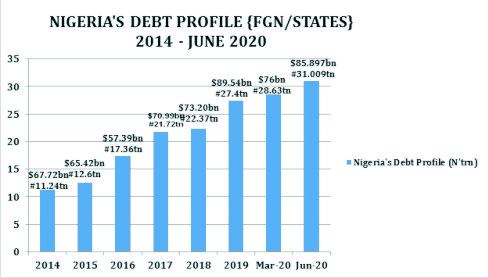

In the past five years, Nigeria has been under the weight of huge debt amounting to N31.01 trillion as of June 30, 2020. Paradoxically, while revenue shrinks, expenditure continues to rise. Investigation by NEXTMONEY revealed that capital and revenue targets were hardly achieved. On the other hand, recurrent budgets were fully executed (see chart). Debt profile has also maintained a worrying upward trend.

However, the Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, at various occasions, insisted that Nigeria’s fiscal challenge hinges on revenue, not debt. “There is a lot of insensitivity around the level of our debt. “I want to restate that our debt is not too high; what we have is a revenue problem. Our debt is still very much within a reasonable fiscal limit”, Ahmed said at the ministry’s management forum in Abuja, August 2019.

Non-essential priorities

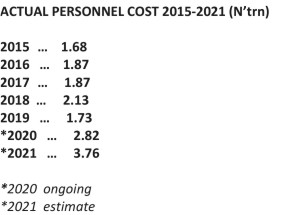

Why would a highly indebted, revenue-challenged country embrace the culture of profligacy as a national priority? High budgetary expenditure for personnel costs (salaries and allowances) remains a sore thumb in Nigeria’s fiscal management. The 2021 fiscal spending plan provides N3.76 trillion (28.75 per cent) of the budget for personnel costs – the largest single item on the recurrent outlay in the budget.

When this (28.75 per cent) is added to the 23.85 per cent of the budget allocated for debt servicing, it means that 52.60 per cent of the 2021 Budget Estimate or N6.88 trillion will be spent on the non-capital items. This excludes N625.50 billion and N501.19 billion (totaling N1.12 trillion) allocated for Overheads; and Pensions, Gratuities and Retirees’ Benefits, respectively. Added to N6.88 trillion this amounts to 8 trillion or 61.53 per cent of the 2021 Budget.

The renovation of the National Assembly will consume N9.2 billion; N128 billion is provided for salaries and allowances of the lawmakers and the bureaucracy of the National Assembly. Construction of the National Assembly library will take ₦4 billion. Maintenance of the presidential fleet will consume N12.5 billion up from N8.5 billion in 2020.

The government said it has set aside a total of N2.6 billion to spend on religious tourism. This comprises programmes and activities of the National Hajj Commission of Nigeria and the Nigerian Christian Pilgrim Commission. They are to receive N1.39 billion and N1.38 billion, respectively. The cost elements, in the case of National Hajj Commission of Nigeria, include general travels and transportation, training and consulting services, refreshment and meals, honorarium, sitting allowance, publicity and advertisement, welfare packages and monitoring activities.

The severe revenue challenge has not posed any constraint on Government in funding religious tourism which has continued to be condemned over the years. “With shrinking revenues to meet priority programmes and activities, the government must cut down drastically on identified areas of wastage and frivolities in the system. One area of such needless wastage is using public funds to finance strictly private religious activities,” Raphael Uchenna, an Abuja based legal practitioner, told Premium Times, an online newspaper in October.

Another worrying aspect of the Budget is the N3.97 billion provided for President Buhari and Vice President Yemi Osinbajo to take care of their food, cars and travels in 2021. Details of the spending plan include N2.4 billion for Buhari’s international and local travels (N1.65 billion and N775 million respectively).

For the Vice President, N801 million has been budgeted for travels for the year. This is made up of N517 million and N283 million for international and local travels, respectively. The budget also shows that N436 million will be spent on purchasing motor vehicles for the State House. An additional N116 million will be spent on tyres for bulletproof vehicles, plain cars, close circuit vehicles, platform trucks, jeeps, Hilux, ambulances and other utility and operational vehicles for the Presidency.

Startling Realities

President Buhari has charged the MDAs to move aggressively for revenue generation. This suggests that more tax burden will be created for individuals and body corporates across the country at the 3-tiers of government (federal, state and local). This will impact on households and the micro, small and medium enterprise (MSME) operators already suffering from effects of infrastructure deficit and multiple taxation. The MDAs are going to be “exploitatively creative” in their revenue generation – meaning that the citizens will bear the brunt of the pains.

Inflation rate presently at 13.71 per cent as of September 2020 (the highest in 30 months), will maintain an upward trend, as the economy slips into the worst recession in four years by 2020 year-end. The hike in price of fuel and electricity tariff will, inevitably, ignite high cost of living. State and private educational institutions will increase their fees or introduce new ones. The unconducive operating environment will discourage foreign direct investment, thereby worsen unemployment rate now 28 per cent as of second quarter of 2020. It is feared that many businesses will close shop which will impact negatively on tax revenue.

Nigeria’s debt profile, which has risen by over 158 per cent in the last five years, will become more challenging. There are fresh concerns over this, as the nation plans to fund the 2021 budget deficit with N4.28 trillion new borrowings. The new borrowing figures represent about a third of the proposed 2021 budget.

Various intervention initiatives have been introduced by the federal government and the CBN to mitigate the effects of the Covid-19 pandemic on households and enterprises. Experts, all the same, believe that Nigeria’s fiscal state is scary and could be worsened by the culture of budget indiscipline underlying lack of prudence in fiscal management. The revenue projection of N7.88 trillion in the 2021 Budget is faulted by experts as largely preposterous given trend of realities.

According to the Director-General, Lagos Chamber of Commerce and Industry (LCCI), Muda Yusuf, the projections pose bigger deficit risks because they are too ambitious when compared with the revenue collected in the last four years of the Buhari government.

He argued: “We have witnessed large negative variances in revenue targets over the last few years. This poses a risk of bigger deficits than projected. The ballooning recurrent expenditure and debt service is a case for concern. The combination of these two-line items exceeds the total revenue expected. The implication is that the entire capital budget would be funded by borrowing. This, therefore, is a cause for concern.”

Optimism, now, dims on early recovery from Covid-19 pandemic effects as Africa’s largest economy tilts towards financial implosion. Evidently, the 2021 Budget, ambitiously tagged ‘Budget of Economic Recovery and Resilience’, may achieve results in anti-clockwise while the country drifts towards bankruptcy as recession looms.

This story was supported by the US embassy via the ATUPA fellowship by Civic Hive