The Treasury Single Account suffers serial breaches suggesting that the policy has lost steam among government agencies

By Samuel Diala

Recent developments in the fiscal policy space reinforce worries that Nigeria’s Treasury Single Account (TSA) policy may have suffered serial breaches among government ministries, departments and agencies (MDAs). And this is sad news for Africa’s largest economy writhing in the throes of acute revenue crisis.

TSA is a financial policy meant to consolidate inflows from all government agencies into a single account at the Central Bank of Nigeria (CBN). This is to ensure efficient management and control of government’s cash resources. Nigerian government under President Muhammadu Buhari put the TSA policy into effect in 2015 – three years after it was introduced by the previous administration. The policy was considered vital in reducing the proliferation of bank accounts operated by the MDAs, promote financial accountability and fight corruption. State governments were urged to adopt the TSA initiative.

The policy

Prior to the TSA regime in September 2015, government MDAs reportedly swam in the flood of bank accounts numbering over 20,000 in different commercial banks. Implementation of the policy led to the closure of the bazaar of bank accounts many of which could not be easily identified by government. The Director of Information Technology Department in the Office of the Accountant General of the Federation (OAGF), Mr. Afolabi Ajayi, disclosed that government had saved over N45 billion in monthly interest on its borrowings from banks. He added that a total of N50 billion revenue from MDAs had also been mopped up from commercial banks since the TSA came on board.

A key aspect of the policy requires the MDAs to remit their gross inflows and maintain zero balance daily. Subsequently, they are to apply and receive funds for their salaries and other operational expenses. Revenue-generating agencies are to remit their inflows after deducting their salaries and other overheads.

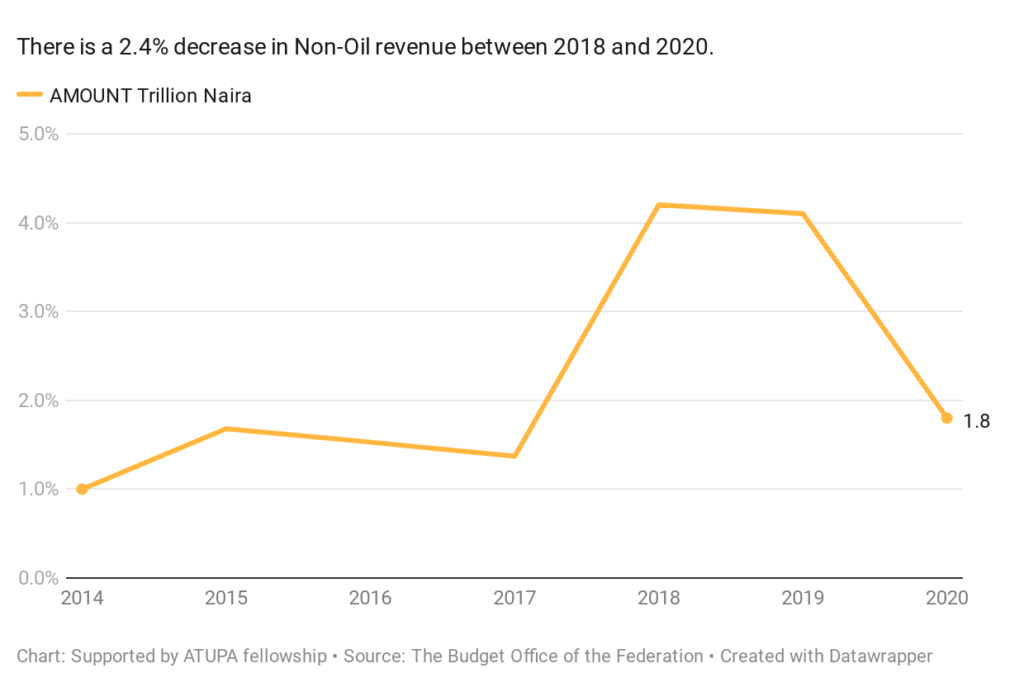

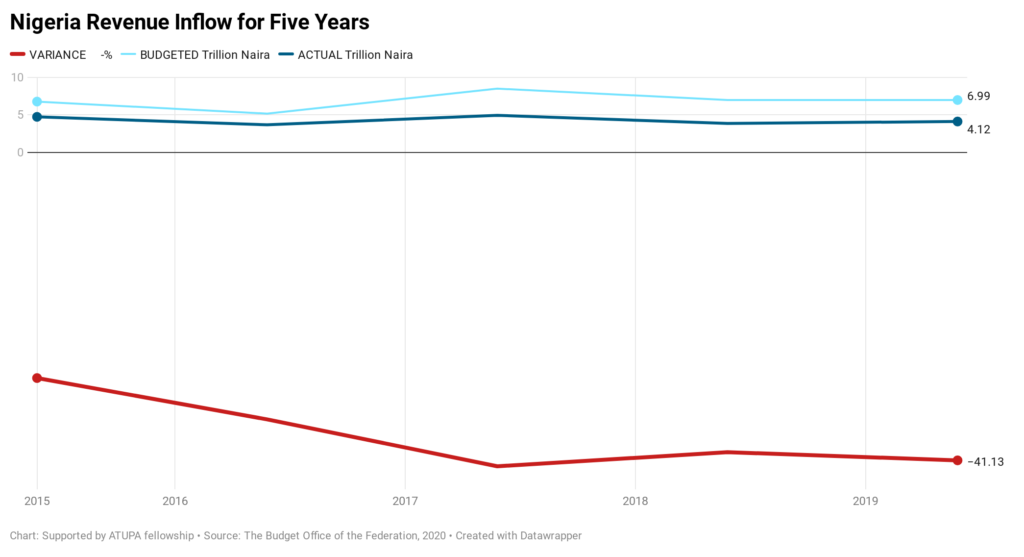

Recent developments, however, indicate that this aspect of the policy is observed in the breach as reports of huge resource mismanagement by the MDAs continue. They default in remitting their inflows while revenue-generating agencies under-remit. And this worsens government’s revenue inflow while adding to the debt burden (see charts).

“This suggests an abuse of the process; it is an indication that the TSA is now observed in the breach,” said Kayode Salami, a Lagos-based financial consultant. Salami told NEXTMONEY that the aggressive move that greeted the implementation of TSA in 2015 seems to have been doused by the usual bureaucratic lethargy that characterizes government business. “Government officials running the system have resorted to business as usual or partial compliance with the TSA – at best. The worst culprits are the revenue-generating agencies. They spend as they like and remit as it pleases them,” Salami said.

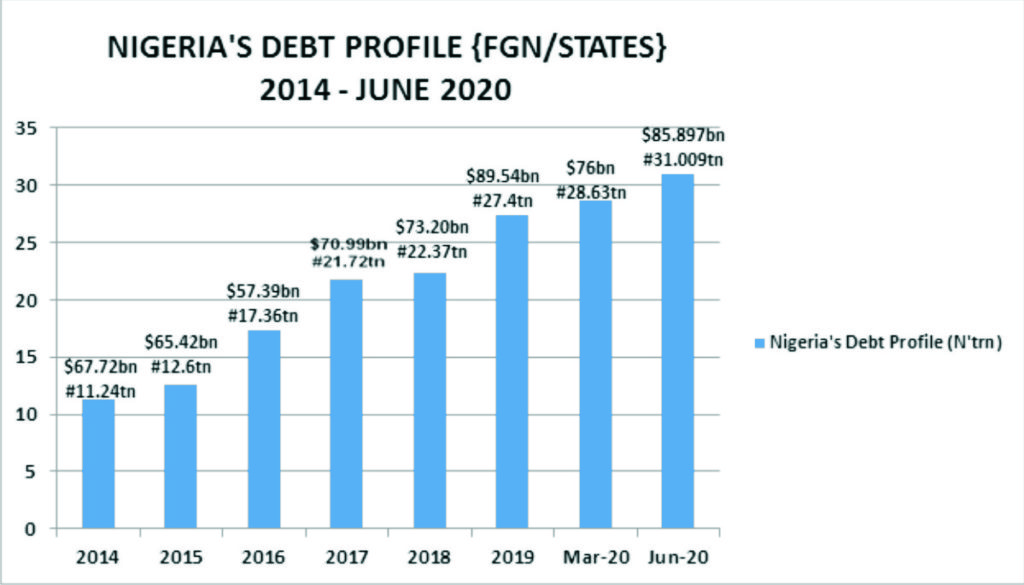

The abuse of the TSA process will add to the woes of an economy tormented by acute dwindling revenue. Nigerian government has suffered unhindered slide in revenue drop since 2014, following the crisis of oil prices in the international market. The ripple effect is lingering and widespread. It leads to budget underperformance and high cost of debt servicing as Nigeria’s debt profile mounts – standing at N31 trillion ($85.89 billion) as at June 30, 2020. Stakeholders express concern that poor implementation of the TSA policy could hasten Nigeria’s slide towards financial implosion – with inflation, unemployment and GDP rates head for the ugly direction.

Wrong signals

Among the smoking furnace against TSA abuse is the National Assembly. The lawmakers have repeatedly expressed concern over the opaque approach in the management of public funds among the MDAs, especially the revenue-generating agencies. Over the years, the lawmakers have beamed their searchlight on the nation’s national oil company – the Nigerian National Petroleum Corporation (NNPC), an albatross with humongous tentacles that are rooted in the culture of waste, mismanagement and abuse of due process; often with impunity.

For this octopus and other agencies of financial panorama, their performance often fell short of expectation as to their required contributions to the Federation Account, giving rise to some doubts about the efficacy of TSA. Other agencies include the Federal Inland Revenue Service (FIRS), Nigeria Customs Service (NCS), Security and Exchange Commission (SEC), National Broadcasting Commission (NBC) and Oil &Gas Free Trade Zone Commission (OGFTZC).

This was the focus of discussions at a session of the Senate’s Joint Committee on Finance and National Planning with heads of the revenue-generating agencies. The session was held in Abuja to consider the agencies’ performance based on the 2021-2023 Medium Term Expenditure and Fiscal Strategy Paper (MTEF/SP). The panel expressed disappointment with the agencies’ poor revenue profile, huge wage bill and poor remittances to the Consolidated Revenue Fund account. To compound the already ugly situation, the same agencies receive budgetary allocations.

“Many of them (the agencies) are generating as much as N20 billion every year, remitting what they like, and they are still collecting money from the federation account to pay salaries and to defray their overhead cost. Apart from removing them from the budget, we will also make sure that they remit the appropriate revenue to the federation account. I was shocked when I saw the huge sums of money that many of these agencies are making, how much they are spending on frivolous expenditure and what they remit to the national purse. It is highly ridiculous,” said Senator Abdulfatai Buhari, a member of the committee.

Similarly, the Director-General, Bureau of Public Enterprises, Alex Okoh, had told the Senate Committee on Privatisation in October 2019 that 600 Federal Government-owned enterprises gulped not less than $3 billion yearly with little or no returns from them into the federation account. NEXTMONEY learnt that the Senate mulls a resolution towards suspending budgetary allocations to revenue-generating agencies from 2021. There are divided opinions about this: While some experts support the move because of the lingering abuse of the TSA process, others express the fear that it could create a window of extortion and exploitation of the public through illegal levies and taxes to be created by the affected agencies.

The Chief Executive Officer, Economic Associates, Dr Ayo Teriba, in a news report, condemned the intransigence of the revenue-generating agencies exemplified in their serial abuse of the TSA process. According to Teriba, all revenues should be remitted into the government’s purse before sharing in order to curtail excesses and leakages: “Allowing agencies to spend their revenue and only remit a certain portion would be an aberration. This is one of the reasons why Nigeria is poor. The country has moved towards a Treasury Single Account. The question to ask is; are the federal agencies the Senate is referring to part of the TSA or not? They are.”

Augean Stables

Disclosures at the Senate’s Joint Committee on Finance and Planning showed outright abuse of the TSA process by many revenue-generating agencies who behave like they are immune from the rule. Among them is the Department of Petroleum Resources, a parastatal under the NNPC. The DPR was among the agencies accused of failing to remit the expected level of revenue to the Federation Account while swimming in its revenue pool as it likes. The Senate queried the agency’s remittance of a meagre N44.5 billion into the Consolidated Revenue Fund out of the N2.4 trillion it generated in 2019, a situation the lawmakers considered mind-boggling.

For instance, the DPR management deducted N88 billion from the N2.4 trillion generated in 2019 as 4 per cent approved collection fee. According to reports, the DPR could not convincingly account for the remaining unremitted collections which it simply classified as “overhead and operational costs” without specific figures tied to them.

A recent report by Premium Times showed that the DPR paid over N8 billion as salary upfront in January 2020 to its staff – quoting daily payment data published on the open treasury portal:

“The review of salary payments between January and April 2020 showed two descriptions. The first description is January 2020 DPR Staff Salary. This has only five beneficiaries and sums to ₦29.6 million. The second description, which is 2020 DPR Staff Upfront Payment, had 605 beneficiaries and summed to ₦8 billion.

“Twenty-nine (29) top officials received between ₦50 million and ₦71.7 million as upfront salary payment. Another 30 received between ₦30 million and ₦49.9 million. 51 staff members received between ₦20 million and ₦29.9 million. One hundred and nineteen (119) others received between ₦10 million and ₦19.9 million. The remaining 375 staff members received between ₦5 million and ₦9.9 million.

“The treasury database also indicated that five DPR staff received double payment in the same period. The first payment was with the description January 2020 Salary while the second payment had the description – 2020 DPR Staff Upfront Payment.

“An example of a recipient of the double payment is top management member of staff (name withheld by this publication) who received a sum of ₦22,755,745.91 twice the same day. While he received ₦6,318,167.93 as January Salary, he also received a second payment of ₦16,437,577.98 as Salary Upfront,” the online newspaper published in its May 20, 2020 edition.

The National Agency for Food, Drug Administration and Control (NAFDAC) confirmed N7 billion under-remittance by it during the Senate Joint Committee sitting, which the agency claimed was spent on inspection of factories during the year. “Over N7 billion spent on inspection! In the past few weeks, we have been talking about Chinese loans when the money is there in the system. We have the money in Nigeria but we are not doing the needful.

“We are not remitting what we are supposed to remit. The private sector will not remit the taxes and you, government agencies, being paid salaries, will not remit. Where will the government get money to fund the capital projects when we have deficit budget every year,” asked Senator James Faleke while scolding NAFDAC.

A report by the Auditor-General for the Federation (AuGF), Anthony Ayine, late 2019, revealed that 265 government agencies violated fiscal and audit rules in 2017. Among the infractions were cases of non-submission of reports, failure to answer audit queries and abuse of the TSA policy. The 2017 audit report showed thatthe majority of the revenue-generating agencies and other MDAs did not remit withholding taxes, value-added taxes, stamp duty, capital gains tax and pay as you earn, among others.

The agencies involved include the Bureau of Public Enterprises (BPE) with unremitted N7.59 billion, National Examination Council (NECO) and the Securities and Exchange Commission (SEC) with N6.67 billion and N2.29 billion respectively, among others. Ayine said the default caused significant reduction in revenue accruable to the Federal Government.

Besides, the auditors found that the agencies dissipated funds on overhead expenditure and extra-budgetary expenditure on contracts, thereby reducing their operating surpluses. The BPE was also involved in unauthorised investment of idle funds without remittance of interest/returns to the Consolidated Revenue Funds to the tune of N24.77 million. The unremitted funds accrued from N13 billion deposit for privatisation and operational bank account with some commercial banks, Ayine lamented, adding that audit reconciliation of operating surplus revealed that N2.82 billion was placed in various banks as of December 31, 2016, without authority and a provision of ₦183.13 million made for doubtful balances – all in violation of the TSA.

It is obvious that cash-strapped Nigerian government is set to wade into the serial abuse of the TSA process by its MDAs which is the major cause of the continued dwindling resources of the Buhari-led administration. The Revenue Mobilization Allocation and Fiscal Commission (RMAFC) has said it is set to commence the drive to recover from all defaulting agencies total unremitted revenues accruable to the Federation Account, including over N10 trillion operating surpluses.

The exercise, scheduled to commence from the first week of October 2020, would involve all unremitted revenues by government ministries, departments and agencies to the appropriate government treasury for the period between January 1, 2016 and December 31, 2019. The RMAFC chairperson, Elias Mbam, disclosed this during an interactive session in Abuja organised by the Commission for consultants engaged to carry out the recovery exercise.

Raising the alarm over the continuous diversion of revenue by government agencies, Speaker of the House of Representatives, Femi Gbajabiamila vowed that the House of Representatives would stop MDAs from diverting revenues they are supposed to remit to the Federation Account. Gbajabiamila also specified that the failings of the revenue-generating agencies pushed the federal government into seeking loans to finance infrastructural development: “We have credible reports that these desperately needed funds have in many cases, been diverted to finance unnecessary trivialities. At the same time, the Government is left scrambling for alternative sources to fund priority projects. We cannot afford this dynamic, and we will not tolerate it anymore.”

- Editor’s Note: This story was supported by the US embassy via the ATUPA fellowship by Civic Hive